FINANCIAL INDUSTRY

Build Financial Integrity

Data Safety Assurance. Protect sensitive financial transactions and data from security risks.

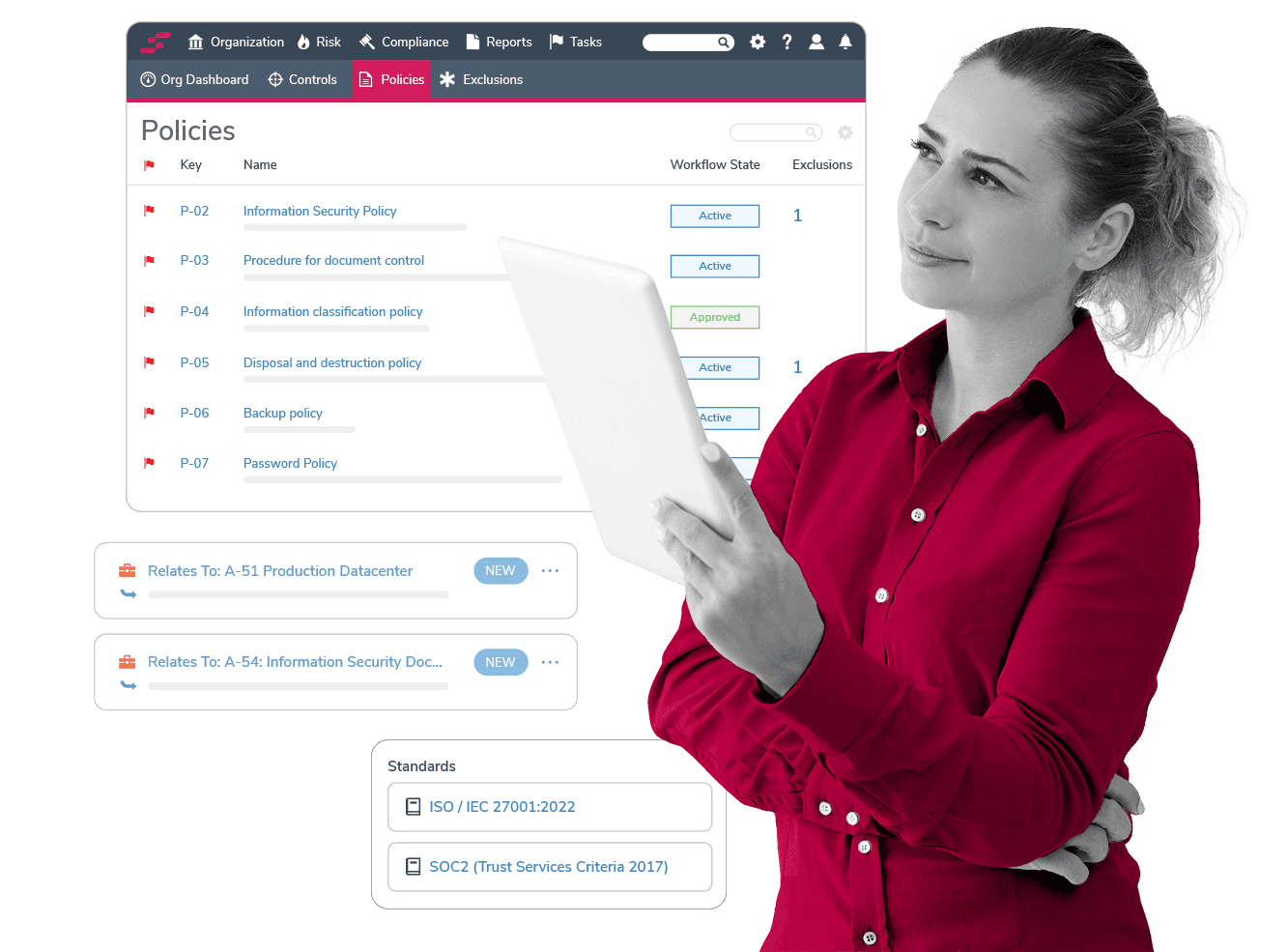

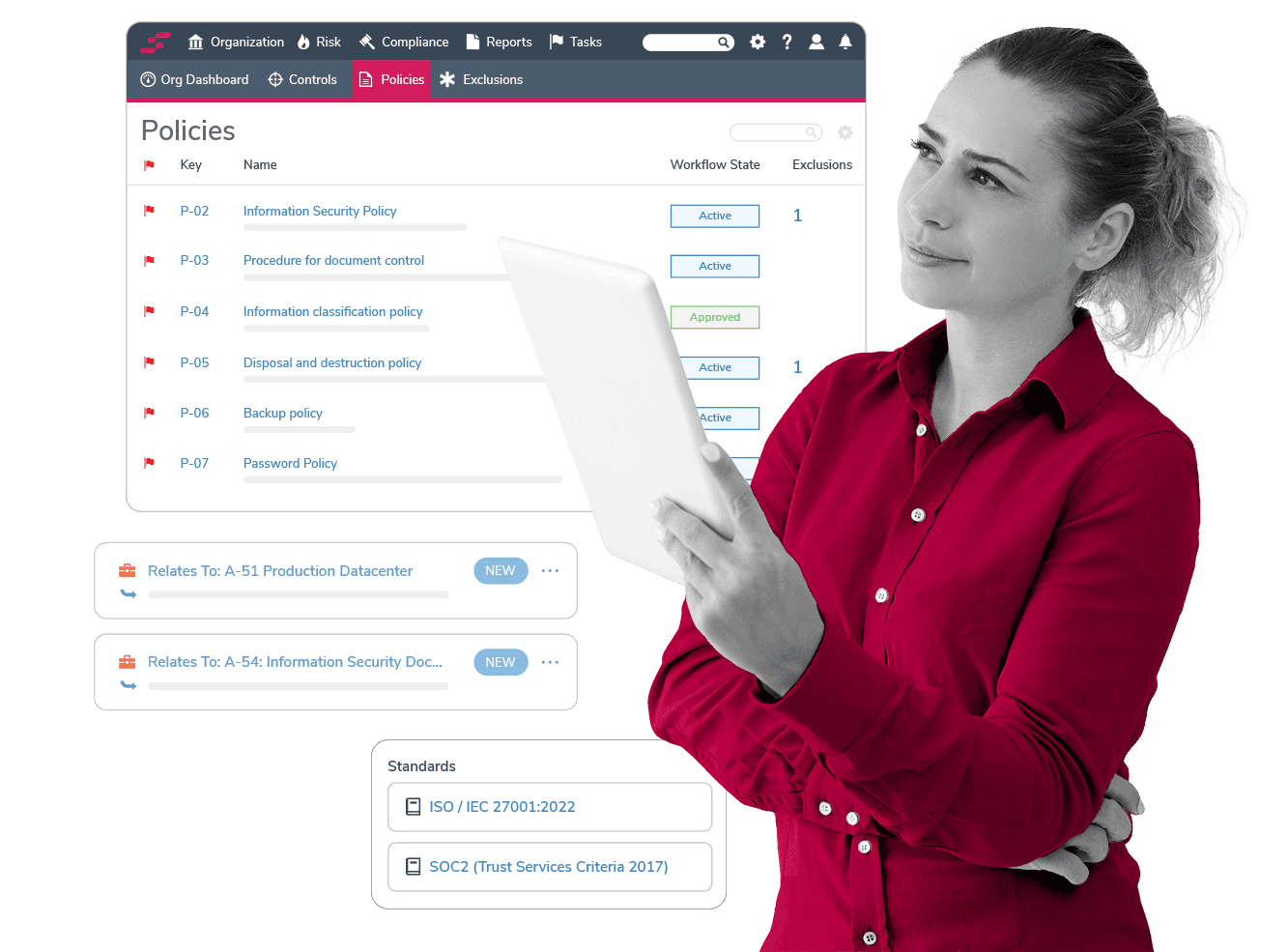

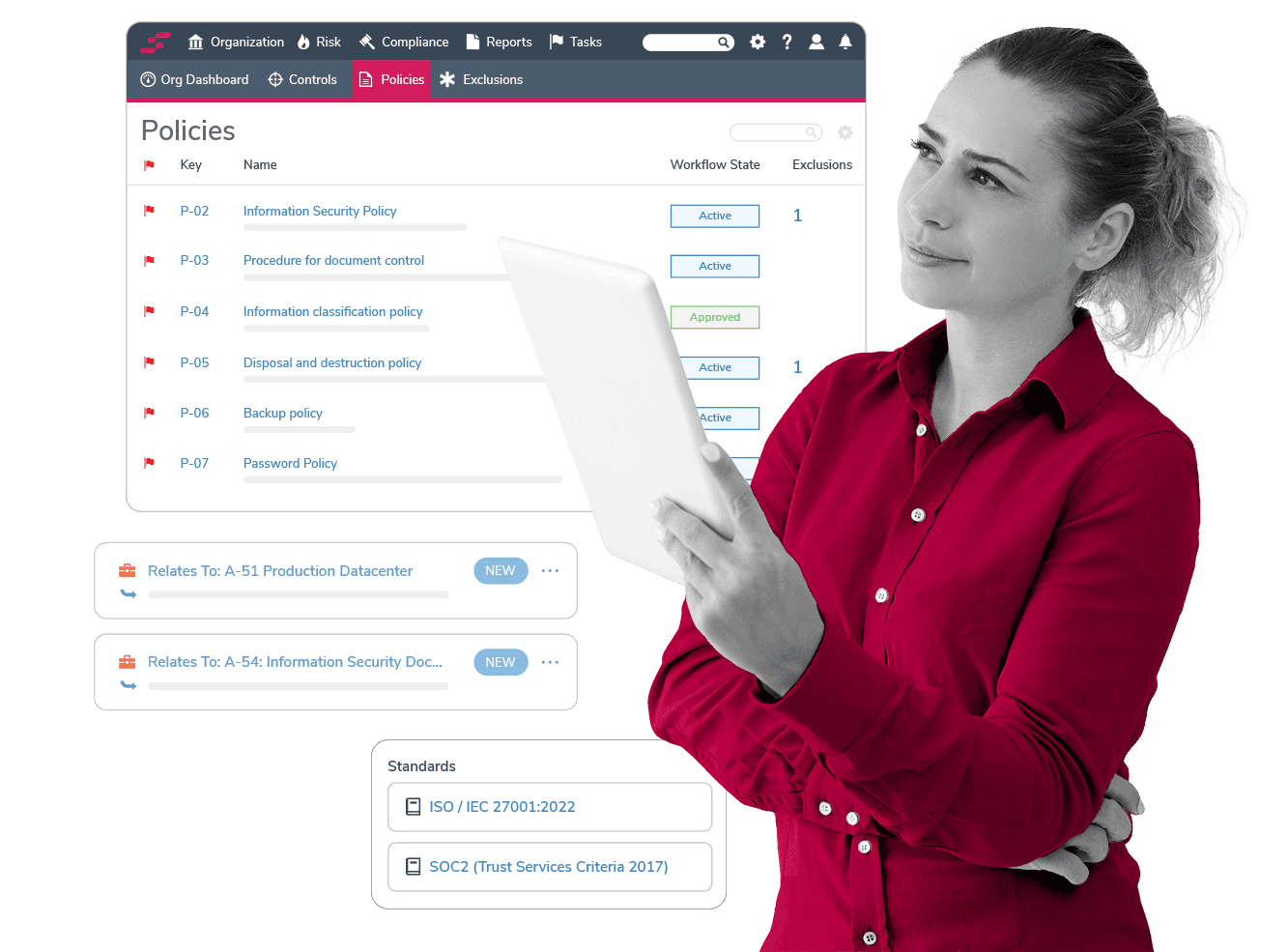

Simplified Compliance. Ensure adherence to regulations and implement governance across your organization.

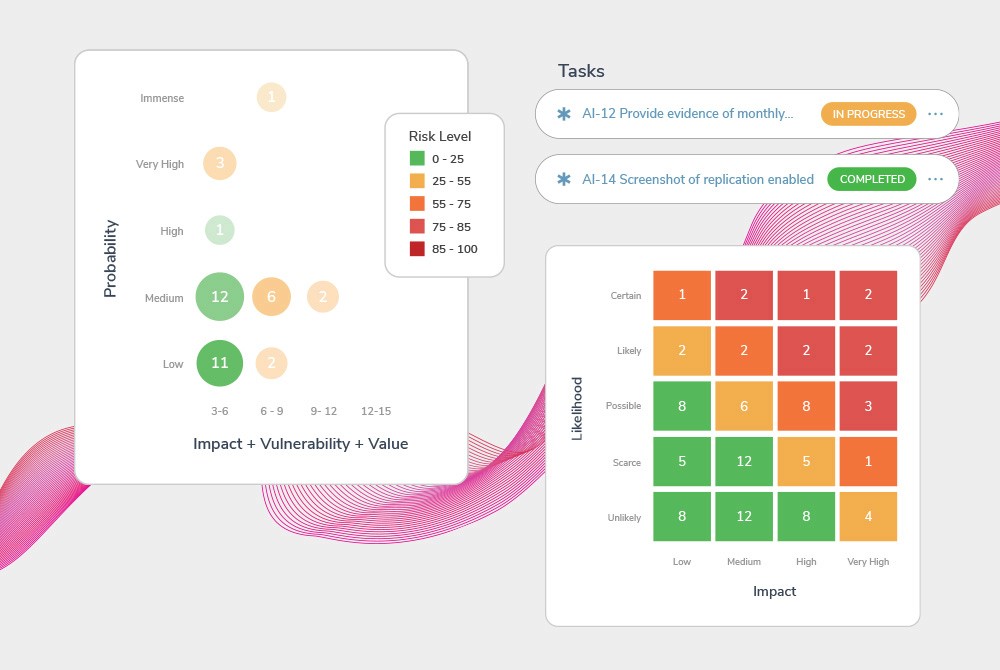

Scalable Risk Management. Proactively identify & mitigate threats, support business continuity and build trust.

FINANCIAL INDUSTRY

Build Financial Integrity

Data Safety Assurance. Protect sensitive financial transactions and data from security risks.

Simplified Compliance. Ensure adherence to regulations and implement governance across your organization.

Scalable Risk Management. Proactively identify & mitigate threats, support business continuity and build trust.

FINANCIAL INDUSTRY

Build Financial Integrity

Data Safety Assurance. Protect sensitive financial transactions and data from security risks.

Simplified Compliance. Ensure adherence to regulations and implement governance across your organization.

Scalable Risk Management. Proactively identify & mitigate threats, support business continuity and build trust.

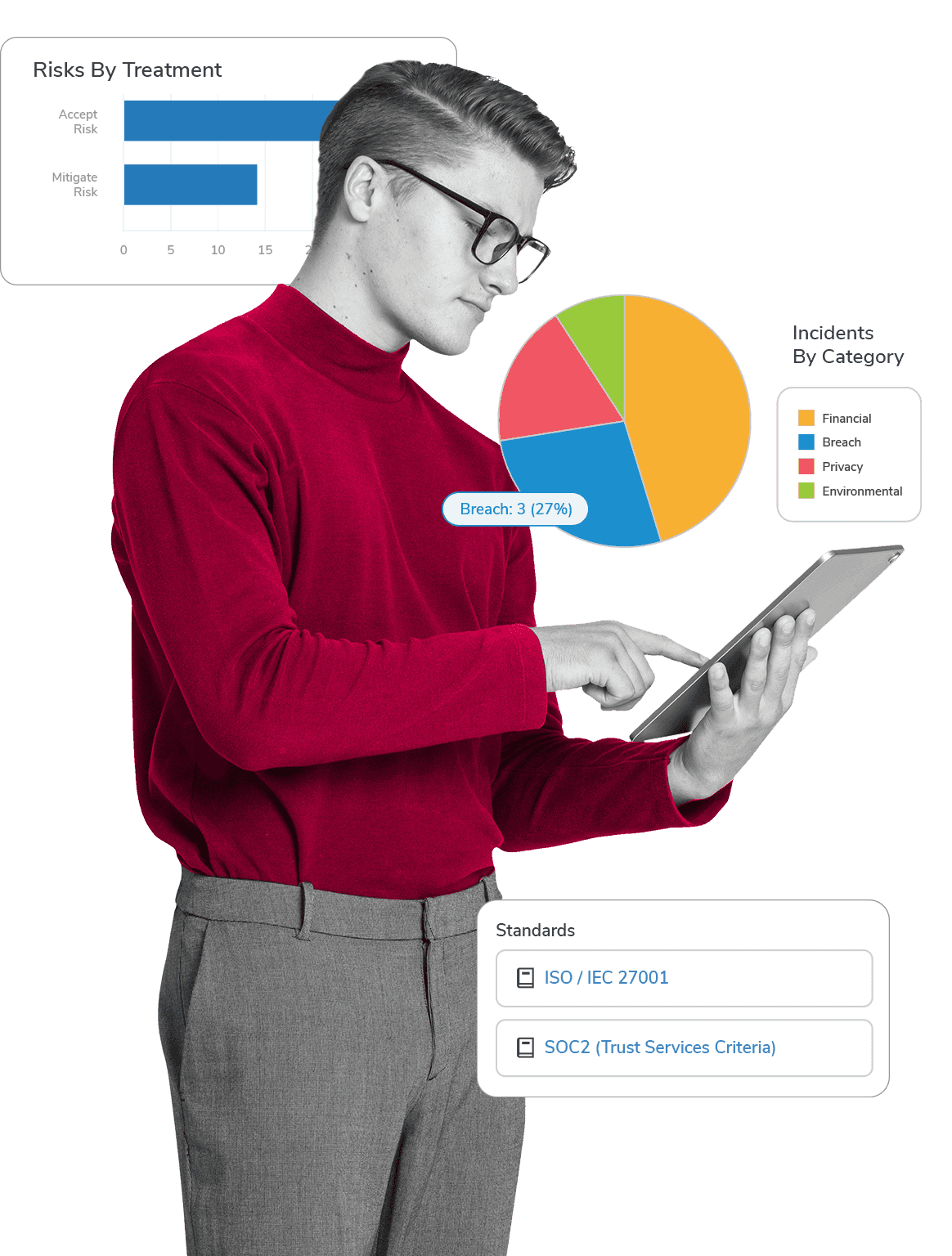

Build Trust Without Just Ticking Boxes

Efficiency, Strategy, and Innovation in Financial Compliance.

Fast Regulatory Adaptation

Agile GRC programs enable swift adaptation to regulatory changes and risk management, ensuring data protection and strategic decision-making in the dynamic financial sector.

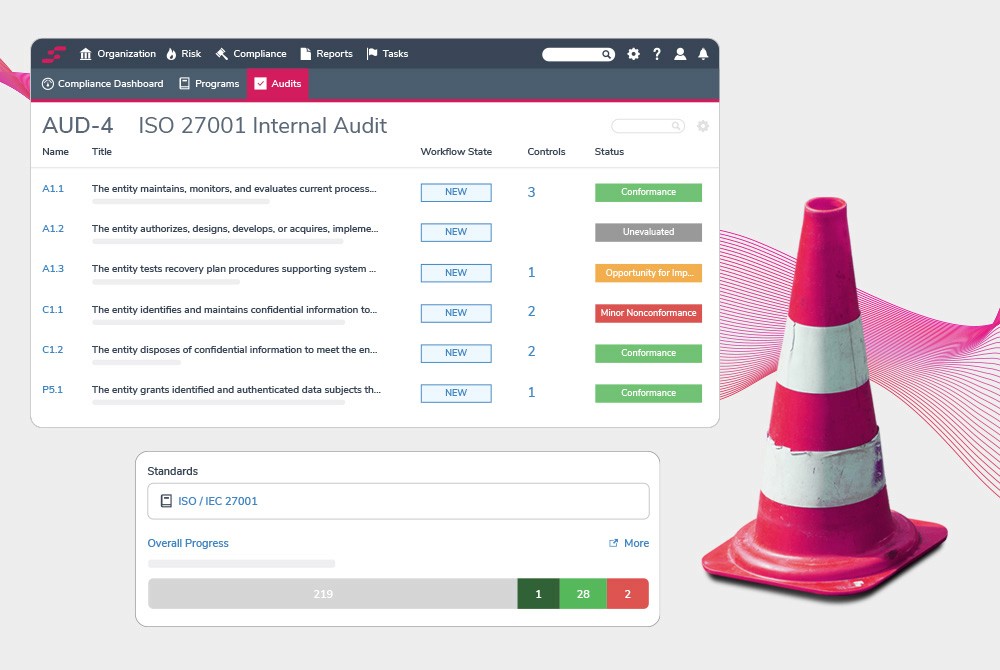

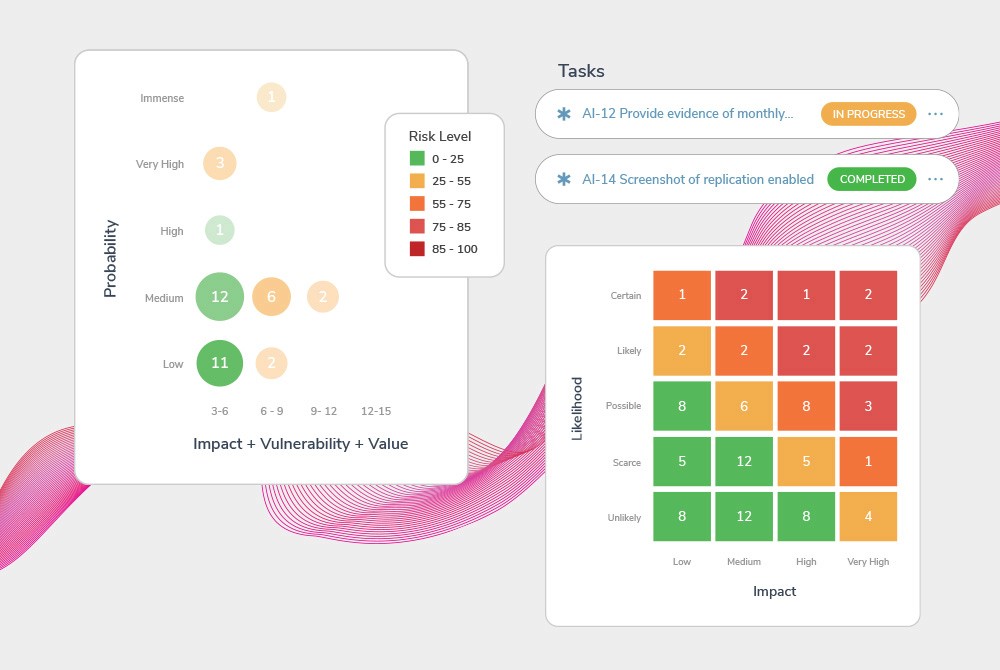

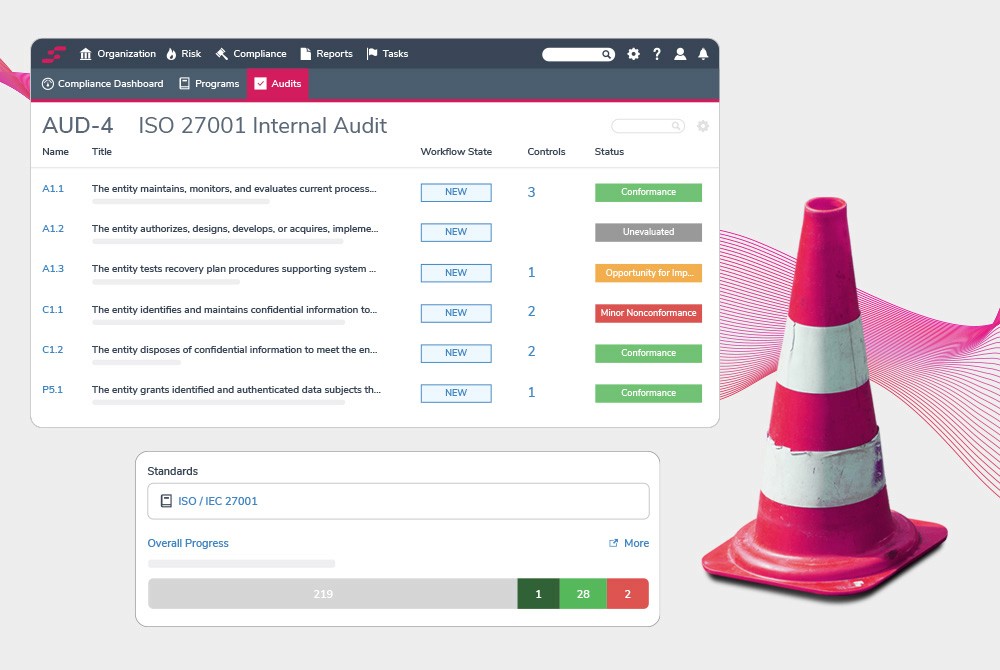

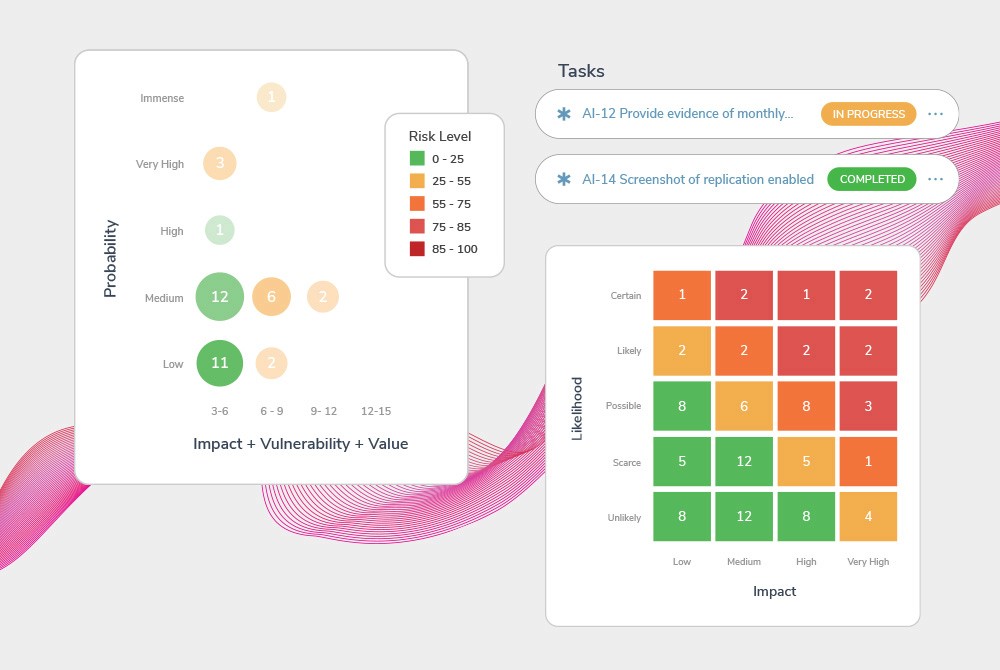

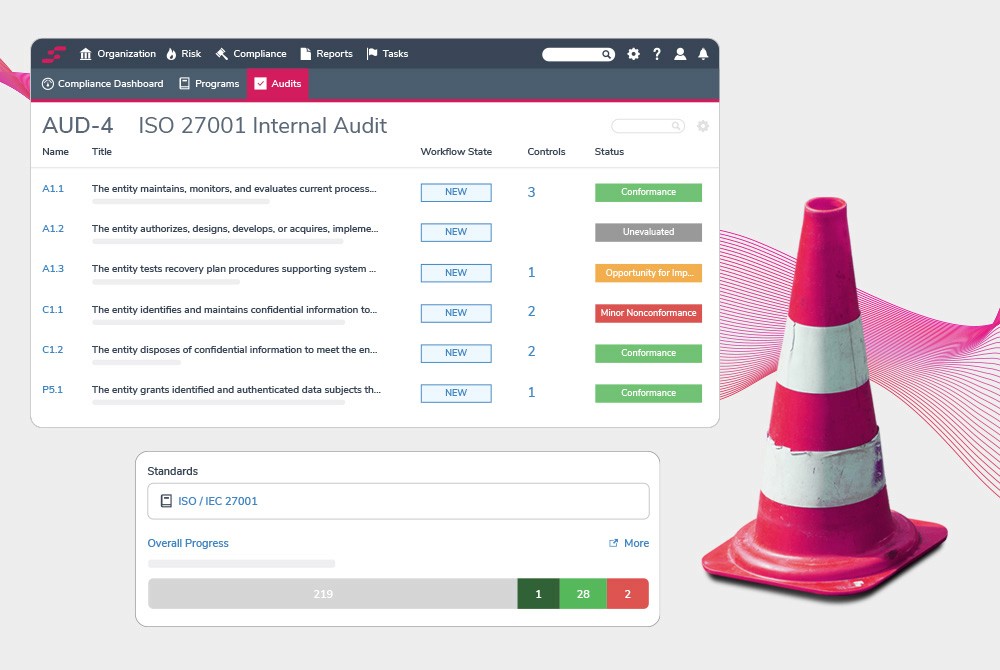

Proactive Risk & Audit Management

Leverage comprehensive risk and audit tools for proactive mitigation of financial risks. Perfectly align risk strategy with evolving market trends to achieve superior operational excellence.

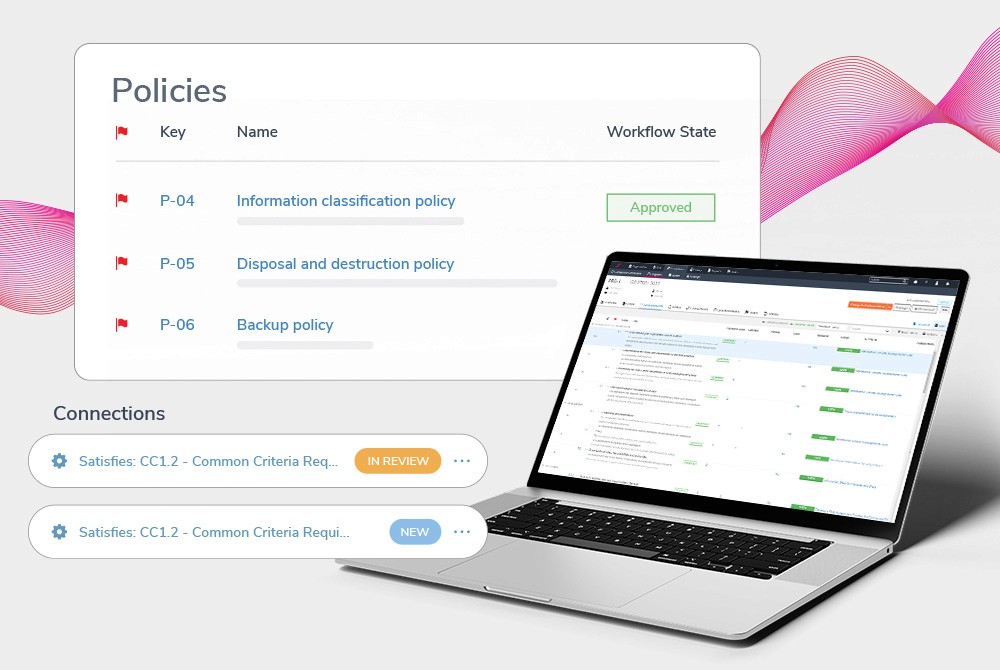

Transparent Financial Governance

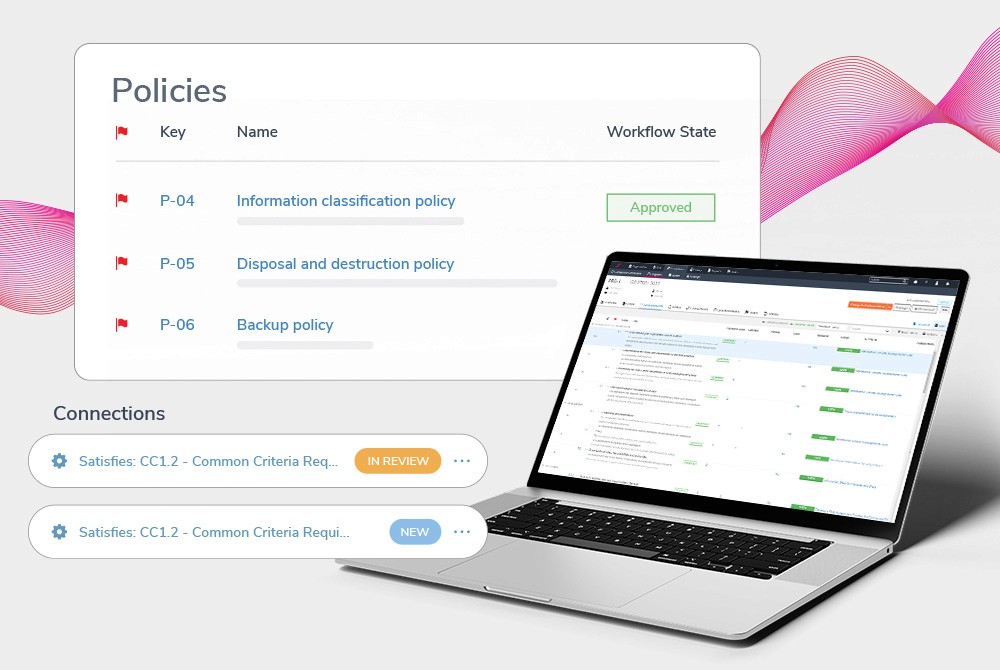

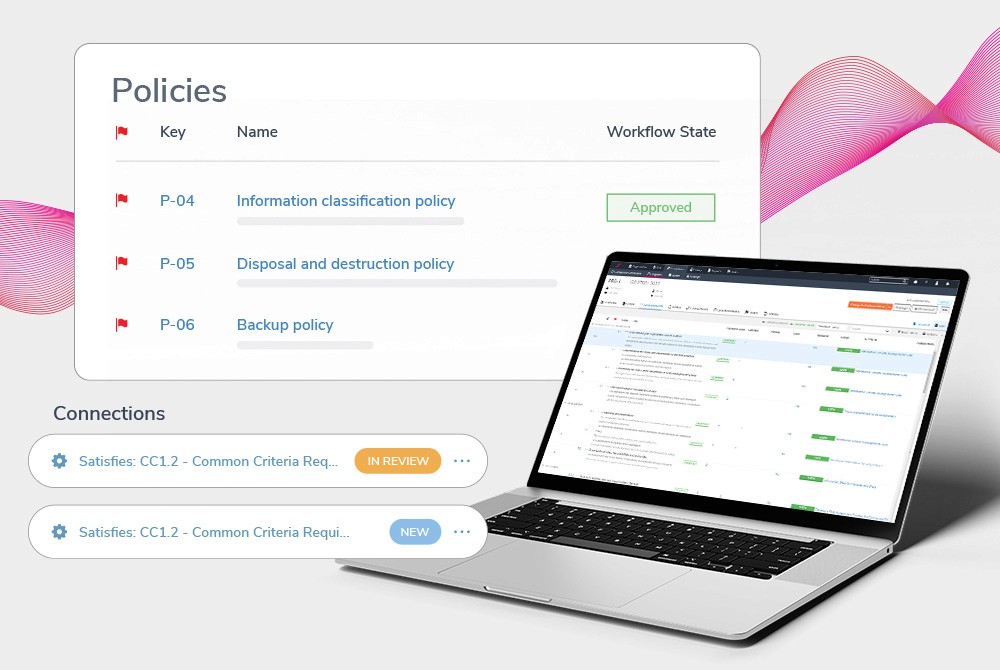

Establish trust and accountability through clear policies and processes, aligning corporate activities with business objectives and enhancing customer and shareholder confidence.

Build Trust Without Just Ticking Boxes

Efficiency, Strategy, and Innovation in Financial Compliance.

Fast Regulatory Adaptation

Agile GRC programs enable swift adaptation to regulatory changes and risk management, ensuring data protection and strategic decision-making in the dynamic financial sector.

Proactive Risk & Audit Management

Leverage comprehensive risk and audit tools for proactive mitigation of financial risks. Perfectly align risk strategy with evolving market trends to achieve superior operational excellence.

Transparent Financial Governance

Establish trust and accountability through clear policies and processes, aligning corporate activities with business objectives and enhancing customer and shareholder confidence.

Build Trust Without Just Ticking Boxes

Efficiency, Strategy, and Innovation in Financial Compliance.

Fast Regulatory Adaptation

Agile GRC programs enable swift adaptation to regulatory changes and risk management, ensuring data protection and strategic decision-making in the dynamic financial sector.

Proactive Risk & Audit Management

Leverage comprehensive risk and audit tools for proactive mitigation of financial risks. Perfectly align risk strategy with evolving market trends to achieve superior operational excellence.

Transparent Financial Governance

Establish trust and accountability through clear policies and processes, aligning corporate activities with business objectives and enhancing customer and shareholder confidence.

Diverse Framework Support

We support a diverse range of frameworks, including financial related standards such as PCI DSS and more.

PCI DSS

PCI-DSS, created by major card brands in 2004, mandates security requirements for credit card data to enhance protection.

GLBA

The Gramm-Leach-Bliley Act mandates financial institutions to disclose data-sharing practices to protect customer information.

NIST

The NIST Framework guides businesses on cybersecurity best practices: Identify, Protect, Detect, Respond, Recover.

SOC2

SOC2 provides assurance on the security, integrity, confidentiality, and privacy of controls processing user data.

Diverse Framework Support

We support a diverse range of frameworks, including financial related standards such as PCI DSS and more.

PCI DSS

PCI-DSS, created by major card brands in 2004, mandates security requirements for credit card data to enhance protection.

GLBA

The Gramm-Leach-Bliley Act mandates financial institutions to disclose data-sharing practices to protect customer information.

NIST

The NIST Framework guides businesses on cybersecurity best practices: Identify, Protect, Detect, Respond, Recover.

SOC2

SOC2 provides assurance on the security, integrity, confidentiality, and privacy of controls processing user data.

Diverse Framework Support

We support a diverse range of frameworks, including financial related standards such as PCI DSS and more.

PCI DSS

PCI-DSS, created by major card brands in 2004, mandates security requirements for credit card data to enhance protection.

GLBA

The Gramm-Leach-Bliley Act mandates financial institutions to disclose data-sharing practices to protect customer information.

NIST

The NIST Framework guides businesses on cybersecurity best practices: Identify, Protect, Detect, Respond, Recover.

SOC2

SOC2 provides assurance on the security, integrity, confidentiality, and privacy of controls processing user data.

Strengthen Your Information Security Programs

Enhanced Transaction Security

GRC processes safeguard sensitive banking and financial transactions against security and privacy risks, ensuring comprehensive data safety.

Regulatory Compliance

Achieve and maintain compliance with stringent industry regulations, effectively minimizing risks such as money laundering, fraudulent transactions, and data theft through proactive governance.

Uninterrupted Financial Operations

Ensure the uninterrupted operation of critical systems by identifying and mitigating cybersecurity threats early, protecting operations and the livelihoods of those dependent on them.

Scalable Compliance Framework

Foster trust through secure, transparent financial transactions and offer a flexible, adaptable solution that grows with evolving legal and regulatory frameworks, meeting future needs efficiently.

Strengthen Your Information Security Programs

Enhanced Transaction Security

GRC processes safeguard sensitive banking and financial transactions against security and privacy risks, ensuring comprehensive data safety.

Regulatory Compliance

Achieve and maintain compliance with stringent industry regulations, effectively minimizing risks such as money laundering, fraudulent transactions, and data theft through proactive governance.

Uninterrupted Financial Operations

Ensure the uninterrupted operation of critical systems by identifying and mitigating cybersecurity threats early, protecting operations and the livelihoods of those dependent on them.

Scalable Compliance Framework

Foster trust through secure, transparent financial transactions and offer a flexible, adaptable solution that grows with evolving legal and regulatory frameworks, meeting future needs efficiently.

Strengthen Your Information Security Programs

Enhanced Transaction Security

GRC processes safeguard sensitive banking and financial transactions against security and privacy risks, ensuring comprehensive data safety.

Regulatory Compliance

Achieve and maintain compliance with stringent industry regulations, effectively minimizing risks such as money laundering, fraudulent transactions, and data theft through proactive governance.

Uninterrupted Financial Operations

Ensure the uninterrupted operation of critical systems by identifying and mitigating cybersecurity threats early, protecting operations and the livelihoods of those dependent on them.

Scalable Compliance Framework

Foster trust through secure, transparent financial transactions and offer a flexible, adaptable solution that grows with evolving legal and regulatory frameworks, meeting future needs efficiently.

Integrations to Power and Scale Your Organization

Enable cohesive automation, transparency, and a unified risk management approach.

Integrations to Power and Scale Your Organization

Enable cohesive automation, transparency, and a unified risk management approach.

Integrations to Power and Scale Your Organization

Enable cohesive automation, transparency, and a unified risk management approach.

Elevate Your Compliance Management in the Financial Industry With StandardFusion

Solutions

Company

300 - 303 W Pender St.

Vancouver, BC V6B 1T3

Canada

Copyright © 2015 - 2025 StandardFusion. All Rights Reserved.

Solutions

Company

300 - 303 W Pender St.

Vancouver, BC V6B 1T3

Canada

Copyright © 2015 - 2025 StandardFusion. All Rights Reserved.

Solutions

Company

300 - 303 W Pender St.

Vancouver, BC V6B 1T3

Canada

Copyright © 2015 - 2025 StandardFusion. All Rights Reserved.